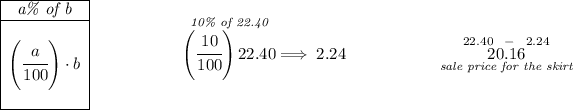

well, let's take a looksie, hmmm she got the skirt for 22.40, but but but, she got a discount of 10% on that hmmm how much will that be?

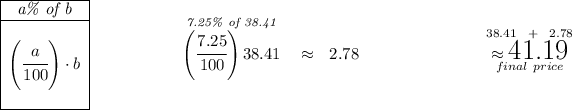

so now, if we add the price of her blouse that'd be a total of 18.25 + 20.16 = 38.41, from that she paid a tax of 7.25%, so