Answer:

Explanation:

(a).

Within 1 year, there would be 4 payments to be made.

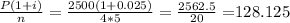

therefore, PMT=

(i) 1st payment will be :PMT $128.125

(ii) 2nd payment will be :128.125*(1.025)^1= $131.33

(iii) 3rd payment will be :128.125*(1.025)^2=$134.61

(iv) 4th payment will be :128.125*(1.025)^3=$137.98

Hence the payments are: $128.125, $131.33, $134.61, and $137.98.

(b).

The size of the final payment

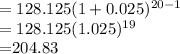

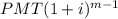

where m 4 *5= 20

where m 4 *5= 20