Answer:

$16,974.57

Explanation:

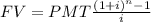

The formula for future value is given by

where

FV = future value

PMT = amount deposited each period and is given as 200

i = rate per period = r/m where r is the interest rate and m the frequency of compounding. Here it is mentioned that r = 2.25% and interest is compounded annually ie once per year so m = 1

i = 2.25%/1 = 2.25% = 2.25/100 = 0.0225

The number of payments n = 48 since we make quarterly payments (4 per year) and we are asked to compute for 12 years

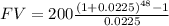

Plugging these values into the formula gives

which evaluates to

$16,974.57 which can be rounded up to $16975

depending on the accuracy you desire