Answer:

Following are the responses to the given choices:

Step-by-step explanation:

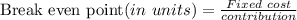

In point a:

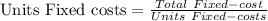

In point b:

Claim of work

Fixed unit costs For sale It is 4,000 units likely

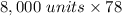

In point C:

Sales(

)

)

Less : Cost of Variable (

)

)

Contribution

Less: Fixed cost

advertising balance

They realize there's no benefit and thus no loss at breakeven pomt.