Answer:

The appropriate answer is "$9,300".

Step-by-step explanation:

The given values are:

FMV,

= $31,000

Adjusted basis,

= $15,500

Encumbered mortgage,

= $9,300

Now,

The Gerald's outside basis will be:

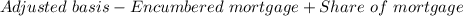

=

On substituting the given values, we get

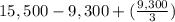

=

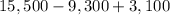

=

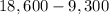

=

=

($)

($)