Answer:

The summary as per the given query is summarized in the explanation section below..

Step-by-step explanation:

The given values are:

The nominal rate of return,

= 7%

i.e.,

= 0.07

Inflation,

= 4%

i.e.,

= 0.04

- Lengthy-term inflation would lessen the return on investment that lowers the net return as long-term investments are made.

- It can also aim to obtain a higher return that will comfortably exceed the rate of inflation and therefore is beneficial towards diminishing the average return.

Now,

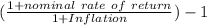

The rate of return will be:

=

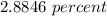

On substituting the values, we get

=

=

=

=

Therefore it isn't able to measure the average return rate because the quantity of years for its expenditure.