Solution :

Current yield of the Bond if the bonds are selling at a price of $ 9980.

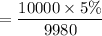

Current yield = annual coupon amount / current selling price

Current yield

= 0.0501

= 5.01 %

The current yield of a bond if the bonds are selling at $ 9350

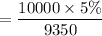

Current yield = annual coupon amount / current selling price

Current yield

= 0.0535

= 5.35 %