Answer:

Following are the responses to the given points:

Step-by-step explanation:

For point a:

Criteria I

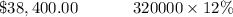

Date: 1-1.2020 Debt Investments

cash

For point b:

Criteria II

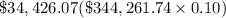

Date: 31.12.2020 Interest Account receivable to pay

Debt Investments

rate of Revenue

31.12-2020 Fair Value Adjustment

Gain or loss - equity unrealized holding

for point c:

Criteria III

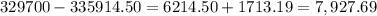

31.12-2021 Interest Account receivable to pay

Debt Investments

rate of Revenue

31.12-2021 Gain or loss - equity unrealized holding

Fair Value Adjustment

Please find the attached table.