Solution :

a).

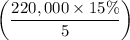

Par value of the bonds outstanding 220,000

Annual interest rate x 10%

Interest payment 220,000

Amortization of the bonds premium 6600

Interest charged for full year 15400

Less:interest on the bond purchased 2567

by Online Enterprise (15400 x 1/2) x

(4 months / 12 months)

Interest expense included in the consolidated 12833

income statement

b).

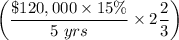

Sale price of bonds, 1 Jan 20x1 138,000

(120,000 x 115%)

Amortization of premium 9600

Book value at time of purchase 128,400

Purchase price 120,000

Gain on bond retirement 8400

c).

Events Accounts Debit Credit

1 Bonds payable 120,000

Bonds premium 6600

interest income 4367

investment in Salt bonds 120,000

Interest expense 2567

Gain on bond retirement 8400

2 interest payable 8100

(4950+11900+8750)

Interest receivable 8100