Answer:

The answer is "$70,400 and $7,600"

Step-by-step explanation:

Given:

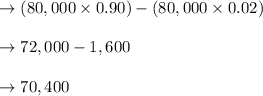

Debit Cash

Debit Loss on Sale of Receivables

Debit on receivable from Factor

Credit on the recourse liability

Credit on receivable accounts

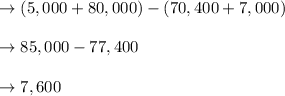

Calculating the Debit cash:

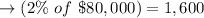

Calculating the Debit Loss on Sale of Receivables: