Answer:

The correct answer is "43,000".

Step-by-step explanation:

The given values are:

Carrying amount,

= $4060000

Face value,

= $3900000

Now,

For June 30, 2021, the Interest expense will be:

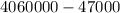

=

=

For June 30, 2021, the cash interest will be:

=

=

Now,

On June 30, 2021, the premium's amortization will be:

= Interest expense - Cash interest

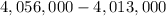

=

=

On retirement, the cash paid will be:

=

=

On June 30, 2021, the less carrying amount will be:

= Carrying amount - amortization

=

=

Then,

The loss on retirement as well as ignoring taxes will be:

= Cash paid - less carrying amount

=

=