Answer:

Projects W and X have lower expected returns

Projects Y and Z have higher expected returns

Explanation:

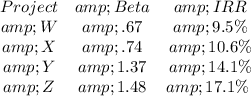

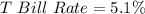

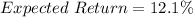

Given

Solving (a): Compare the expected return of each project to 12.1%

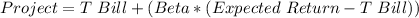

Expected Return of each project is calculated as:

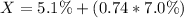

For Project W:

Lower Expected return

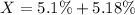

For Project X:

Lower Expected return

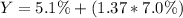

For Project Y:

Higher Expected return

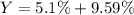

For Project Z:

Higher Expected return

There is no question in (b)