Answer:

a.) 1908.30

b.) 96373.15

c.)302491.15

unrounded answers below

Explanation:

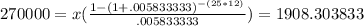

The amount that is to be loaned out is 380000-110000=270000

The effective montly rate is .07/12=.005833333

a.)

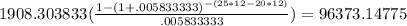

b.)

use what is called the prospective method (the outstanding loan balance at time n is equal to the present value of the remaining payments)

c.)

total paid= 1908.303833*12*25=572491.1499

amount of loan: 270000

Total interest paid:

572491.1499-270000=302491.1499