Answer:

The answer to this question can be defined as follows:

Step-by-step explanation:

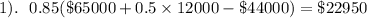

For point a:

Chargeable advantages to social welfare:

Pension benefits etc $35 thousand

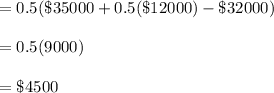

Total AGI=

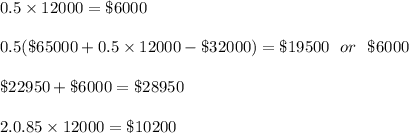

For point b:

Additional revenue

Taxable

AGI =

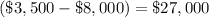

Less: AGI in (a)

Decrease

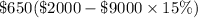

Tax payers' financial income has been down by

, but taxable AGI is down by $9,000. The reduction of

, but taxable AGI is down by $9,000. The reduction of

with a

with a

MTR after the tax income.

MTR after the tax income.

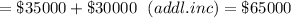

For point c:

The least of follows

Smaller than that one

Calculated amount with the first formula

Less:

That is why Linda and Don have

of their gross income from the SSB

of their gross income from the SSB

.

.

The benefits of social security

Additional revenues

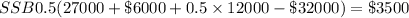

AGI

Less (a) AGI (

)

)

Increases

AGI growth exceeds earnings increases because more SSB is taxed.