Answer:

It will make yearly deposits of $ 6,053.60

Step-by-step explanation:

First, we have two phases:

the first which is the accumulation phase:

<---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|--->

^

which lasts until Sam's 1st year.

Then, we have the withdrawals phase

Graduation of Ellie

<---|----|----|----|----|----|---->

^Sam 1st year

^Ellie 1st year

We solve for the value of sam's first college year.

21,225 (1.03)^16 = 34,059.89

Then we solve for the present value of a growing annuity:

![\displaystyle (P)/(r-g) \left[1 - \left((1+g)/(1+r)\right)^n \right] \\P = $first payment\\r = interest\\g= growth\\n = time](https://img.qammunity.org/2022/formulas/business/college/jxxfk9xlf5uezfw739eqt06s2huymzbry1.png)

![\displaystyle (34059.89)/(0.09-0.03) \left[1 - \left((1+0.03)/(1+0.09)\right)^4 \right]](https://img.qammunity.org/2022/formulas/business/college/bt426g0q63sxdtjl88iw55a20r7au3h2ok.png)

PV = 115,043.63

Then we do the same with Ellie:

P $36,134.1373 (we adjust by two years)

r 0.09

g 0.03

n 4

PV 122,049.78

and then, we adjust for the 2-years difference:

122,049.78 / 1.09^2 = 102726.8613

Value of tuiton cost in 16 years for both daughters:

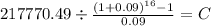

115,043.63 + 102,726.86 = 217,770.49

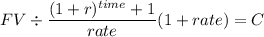

Now we solve for the yearly payment of an annuity due ( as the professor pays at the beginning) of 16 years:

Installment of a future annuity

FV $217,770.49

time 16

rate 0.09

C $ 6,053.602