Solution :

1st June : No entry -- neither party has performed under any the contract.

On 1st Sept. 2020

Windows = $ 1,980

Installation = $ 600

Total = $ 2,580

Allocation :

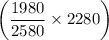

Windows

= $ 1,749

= $ 1,749

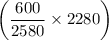

Installation

= $ 530

= $ 530

Revenue recognized = $ 1,749 + $ 530

= $ 2,279

To record sales

Cash = $ 1,980

Account receivable = $ 299