Answer:

12.5%

Step-by-step explanation:

It is given that :

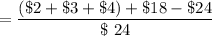

Nico bought shares from Cisco Systems = 100 shares

The stock of 100 shares on 1st Jan 2002 = $ 24 per share

At the end of 2002, Nico received a dividend = $ 2 per share

At the end of 2003, Nico received a dividend = $ 3 per share

At the end of 2004, Nico received a dividend = $ 4 per share

Nico sold his stock = $ 18 per share

Therefore,

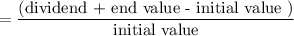

The holding period