Answer:

$143.40

Step-by-step explanation:

The dividend for the next year =

= $ 1.50 x (1 + 0.13)

= 1.50 x 1.30

= $ 1.95

The dividend in the second year = 1.95 x 1.30

= $ 2.54

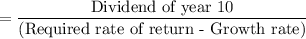

Similarly, the dividend for the year 9 is =

= $ 15.91

The value of the stock at the end of year 9,

= $ 208.81

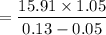

The present value factor

where, r = rate of interest = 13% = 0.13

n = years (1 to 9)

So, the present value factor for the 2nd year is

= 0.783147

Therefore, the price of the stock today is calculated as to be $ 143.40