Answer:

$ 4,748

Step-by-step explanation:

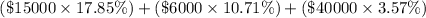

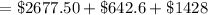

The depreciation expenses =

= $ 4748

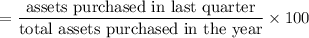

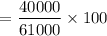

Generally we have use half year convention for assets that are purchased during the year but here we used the mid quarter as of more than the 40% of the assets are being purchased in last quarter of the year

(it is more than 40%)

(it is more than 40%)

Thus we can use the mid quarter mars depreciation rates for the 7 years assets that are purchased this year.