Answer:

Follows are the solution to the given points:

Step-by-step explanation:

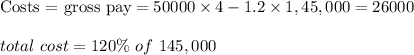

For point A:

Cost with accounting=The actual manufacturing expenditures or spendings that appear on expensive sports or record of a company=

Cost opportunity=75,000

Total revenue required besides positive accounting benefits=cost of accounting =145000

Income to create positive economic benefits=cost of accounts + implied cost

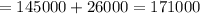

For point B:

Income required to make positive profit in accounts = 145,000 more than the accounting costs

Revenue necessary to earn positive profit = 220,000 more than opportunity cost