Final answer:

To find out how much the company should invest today, we need to calculate the present value of the future cash flow. Given that the future value is $500,000 in 40 years and the interest rate is 10%, the present value is approximately $39,877.63.

Step-by-step explanation:

To find out how much the company should invest today, we need to calculate the present value of the future cash flow. Using the formula for present value, we can determine the amount.:

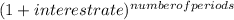

Present Value = Future Value /

Given that the future value is $500,000 in 40 years and the interest rate is 10%, we can calculate the present value as follows:

Present Value = $500,000 /

= $39,877.63

= $39,877.63

Therefore, the company should invest approximately $39,877.63 today to have a future value of $500,000 in 40 years.