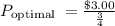

Based on the given information, the profit-maximizing price is $4.00.

The profit-maximizing price is a dynamic concept influenced by both cost considerations and the responsiveness of consumer demand. Elasticity of demand plays a crucial role in guiding businesses toward setting prices that align with market dynamics and maximize overall profitability.

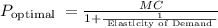

To find the profit-maximizing price, we can use the formula for the optimal price when considering elasticity of demand:

Where:

is the profit-maximizing price.

is the profit-maximizing price.

MC is the marginal cost.

Elasticity of Demand = −4 (negative because it's elastic).

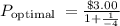

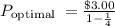

Given:

MC = $3.00 (cost per gallon from the supplier).

Elasticity of Demand = −4.

Substituting these values into the formula:

So, $4.00 is the profit-maximizing price. Thus, option B is the correct answer.

Correct Question:

You are the manager of a Mom and Pop store that can buy milk from a supplier at $3.00 per gallon. If you believe the elasticity of demand for milk by customers at your store is -4, then your profit-maximizing price is

A. $2.50.

B. $4.00.

C. $2.00.

D. $5.00.