The value of the cash flow of $1500.00 at the end of Year 3 is approximately $1224.51.

The present value of all cash flows is approximately $3205.61.

How is that so?

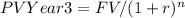

1. Define the variables:

- FV: Future value of each cash flow (given)

- PV: Present value of each cash flow

- r: Interest rate (given as 7%)

- n: Number of periods (year)

2. Calculate the individual present values:

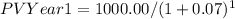

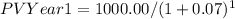

2.1. Year 1:

FV: $1000.00

r: 7%

n: 1

≈ 934.58

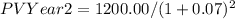

2.2. Year 2:

FV: $1200.00

r: 7%

n: 2

≈ 1046.52

2.3. Year 3:

FV: $1500.00

r: 7%

n: 3

≈ 1224.51

3. Calculate the total present value:

PV Total = PV Year 1 + PV Year 2 + PV Year 3

PV Total = 934.58 + 1046.52 + 1224.51 ≈ 3205.61

Therefore, the present value of all cash flows is approximately $3205.61.

Below is the complete question:

Suppose there is an investment project with the following cash flows to be received at the end of next three years $1000.00, $1200.00, $1500.00. If the interest rate is 7 percent: (a) What is the value of these cash flows at the end of Year 3? (b) What is the value of these cash flows today (today is Year 0) ?