Final answer:

To calculate the future value of a $3000 CD at a 4% interest rate, compounded monthly for 20 years, use the compound interest formula, which results in an amount of $6,609.12 after 20 years.

Step-by-step explanation:

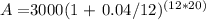

The question posed by the student involves calculating the future value of an investment in a certificate of deposit (CD) that compounds interest monthly. To determine how much will be in the account after 20 years when you invest $3000 at a 4% annual interest rate, compounded monthly, you would use the compound interest formula:

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial amount of money).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the time the money is invested for, in years.

Plugging in the values:

After calculating and rounding to the nearest cent:

A = $6,609.12

Therefore, after 20 years, the account will have $6,609.12