Answer:

Taxes would be $6,845.80.

Explanation:

Note:

- Taxes are compulsory payments made by individuals or entities to a government, typically based on income, wealth, or other criteria. Taxes are used to fund government activities, such as education, healthcare, and infrastructure.

- Annual salary is the total amount of money earned by an individual from a job in a year. It is usually calculated per calendar year, covering the period from January to December.

For the Question:

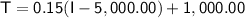

In order to calculate the taxes on an annual salary of $43,972.00(I) using the given tax formula:

We need to plug the value of I(the annual salary) into the formula.

In this case, I = $43,972.00,

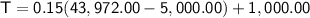

So, substituting the value of I

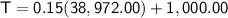

Calculate the value inside the parentheses:

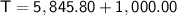

Calculate the multiplication:

Add the number:

So, the taxes (T) on an annual salary of $43,972.00 would be $6,845.80.