Answer:

Step-by-step explanation

- x = amount invested in stocks

- y = amount invested in bonds

- z = amount invested in money markets

Each amount is in dollars. The variables x,y,z are nonnegative.

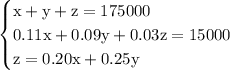

The total of those three groups gives the first equation x+y+z = 175000

The second equation 0.11x+0.09y+0.03z = 15000 is the idea where stocks return 11%, bonds 9%, and money markets return 3%. Those subtotals are then required to return a grand total of $15000. This is over a one year period.

The third equation is from the info that "the amount invested in the money market account should be equal to the sum of 20% of the amount invested in stocks and 25% of the amount invested in bonds"

z = 20% of stocks + 25% of bonds

z = 20% of x + 25% of y

z = 0.20x + 0.25y