Final answer:

To calculate the amount of money the worker will have at age 60, use the formula for compound interest. The worker will have approximately $493,373.16. To calculate the amount of money the worker will have at age 65, use the same formula with a time period of 30 years. The worker will have approximately $805,738.84.

Step-by-step explanation:

In order to calculate the amount of money the worker will have in their fund when they are 60 years old, we need to use the formula for compound interest. We have the monthly deposit of $750, the annual interest rate of 6.0% compounded monthly, and the time period of 25 years (60 - 35). We can use the formula:

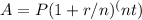

Where:

A = the future value of the investment

P = the principal investment amount (monthly deposit)

r = the annual interest rate (as a decimal)

n = the number of times that interest is compounded per year

t = the number of years

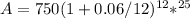

Plugging in the values, we get:

Using a calculator, we find that A ≈ $493,373.16.

To calculate the amount of money the worker will have for retirement at age 65, we can use the same formula, but with a time period of 30 years (65 - 35). Plugging in the values, we get:

A = 750(1 + 0.06/12)⁽¹²ˣ²⁵⁾

Using a calculator, we find that A ≈ $805,738.84.