Final answer:

To calculate the savings plan balance after 3 years with a 7% APR and $300 monthly payments, we use the future value of an annuity formula. The monthly interest rate is 0.00583, and there are 36 payments. Plugging these values into the formula will provide the savings plan balance.

Step-by-step explanation:

To find the savings plan balance after 3 years with monthly contributions and a given annual percentage rate (APR), we can apply the formula for the future value of a series of payments, also known as the annuity formula. In this case, the student is making monthly payments of $300 at an APR of 7%. Since the interest is compounded monthly, we first convert the annual rate to a monthly rate by dividing by 12. Thus, the monthly interest rate is (7% / 12) or 0.00583(approximately).

We calculate the future value (FV) using the formula:

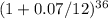

FV = PMT * ((

- 1) / r)

- 1) / r)

where:

- PMT is the monthly payment

- r is the monthly interest rate

- n is the total number of payments (months)

In this case:

- PMT = $300

- r = 0.07 / 12

- n = 3 * 12 = 36

Plugging these values into the formula gives,

FV = $300 * ((

- 1) / (0.07/12))

- 1) / (0.07/12))

This calculation will give the total savings plan balance after 3 years.