Final Answer:

Premier, Incorporated's stock is valued at $2,366.50 per share today. This calculation is based on the Dividend Discount Model, considering a current dividend of $10.50, a constant growth rate of $8.50 for the next four years, and a required return of 14%.

Step-by-step explanation:

Premier, Incorporated, has an unconventional dividend policy with a fixed increase of $8.50 per share for the next four years. To determine the present value of future dividends, we employ the Dividend Discount Model (DDM). This model considers the current dividend, the constant growth rate, and the required rate of return.

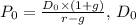

In the formula

represents the current dividend of $10.50 ,

represents the current dividend of $10.50 ,

is the growth rate of $8.50, and

is the growth rate of $8.50, and

is the required return of 14% or 0.14. The calculation yields the present value of Premier's stock. This reflects the sum an investor should be willing to pay today, considering the expected future dividends and the required rate of return.

is the required return of 14% or 0.14. The calculation yields the present value of Premier's stock. This reflects the sum an investor should be willing to pay today, considering the expected future dividends and the required rate of return.

It's important to note that the perpetual cessation of dividends after the initial four years impacts the calculation, emphasizing the significance of the fixed growth rate during that period. The resulting present value provides insight into the valuation of Premier, Incorporated's stock based on its unique dividend policy and the investor's required rate of return.