Answer:

Explanation:

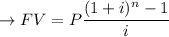

To determine the amount the Turner family needs to pay into the annuity each month, we can use the formula for the future value of an ordinary annuity:

Where:

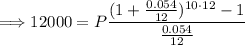

- FV = Future value of the annuity ($12,000 in this case)

- P = Payment at end of each period (unknown)

- i = Monthly interest rate (5.4% divided by 12, or 0.054/12)

- n = Number of compounding periods (10 years multiplied by 12 months, or 10 · 12)

Substituting the known values into the formula, we can solve for P:

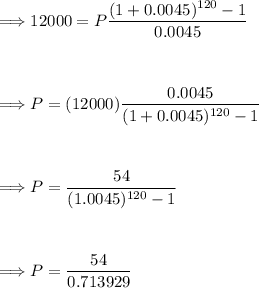

Now, let's calculate it:

Using a calculator, we find:

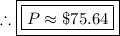

Therefore, the Turner family needs to pay approximately $75.64 into the annuity each month in order to have a total value of $12,000 after 10 years.