Final answer:

To retire with $1.25 million at age 65, Jennifer needs to save approximately $286.45 per month starting at age 20, given an annual interest rate of 8%, compounded monthly.

Step-by-step explanation:

Retirement Savings Calculation

To determine how much Jennifer needs to save every month to reach her goal of $1.25 million by age 65, we use the future value of an annuity formula, which considers regular deposits into an account that earns compound interest. Given an average annual interest rate of 8%, we need to find the monthly savings amount that will accumulate to the desired retirement fund over the course of 45 years—since Jennifer is currently 20 years old.

The future value of an annuity formula is:

FV = P * [(

/ r] where:

/ r] where:

- FV is the future value of the annuity

- P is the periodic payment

- r is the periodic interest rate

- n is the number of periods

Using a financial calculator or an algebraic approach, we can solve for P, which is the amount Jennifer needs to save each month. With an 8% annual interest rate compounded monthly, r = 0.08/12 per month, and n = 45 years * 12 months/year, we find:

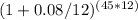

P = FV / [(

) / r]

) / r]

P = 1,250,000 / [(

- 1) / (0.08/12)]

- 1) / (0.08/12)]

After calculations, Jennifer needs to save approximately $286.45 per month for the next 45 years to retire with $1.25 million, assuming an 8% return on investment.