Maximum Profit:

- The optimal contribution to profit is \$626,050.

To solve this problem, we need to develop a linear programming model that maximizes the profit from producing Regular and Super fuels, considering the constraints provided.

Variables:

-

: Barrels of inputs 1, 2, 3 used to produce Regular fuel.

: Barrels of inputs 1, 2, 3 used to produce Regular fuel.

-

: Barrels of inputs 1, 2, 3 used to produce Super fuel.

: Barrels of inputs 1, 2, 3 used to produce Super fuel.

Objective Function:

Maximize profit, given by:

![\[ \text{Profit} = (18.5 * \text{Total Regular}) + (20 * \text{Total Super}) - \text{Total Cost} \]](https://img.qammunity.org/2024/formulas/engineering/college/shawldw3ft63cpk4ci23vtaab2j38lyp8a.png)

where

![\[ \text{Total Regular} = R_1 + R_2 + R_3 \]](https://img.qammunity.org/2024/formulas/engineering/college/2jb5vgl9q1a9oyrwrppo1e65y9dq1czsri.png)

![\[ \text{Total Super} = S_1 + S_2 + S_3 \]](https://img.qammunity.org/2024/formulas/engineering/college/hlm03mcju3r0afadm40o1977bkjx5k784z.png)

![\[ \text{Total Cost} = 16.5R_1 + 14R_2 + 17.5R_3 + 16.5S_1 + 14S_2 + 17.5S_3 \]](https://img.qammunity.org/2024/formulas/engineering/college/ad6kzwdet0ro67q57hopqm9wawsj2twqn7.png)

Constraints:

1. Octane Level for Regular and Super:

- Regular:

- Super:

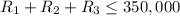

2. Maximum Demand:

- Regular:

barrels

barrels

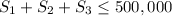

- Super:

barrels

barrels

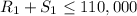

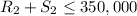

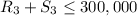

3. Availability of Inputs:

-

-

-

4. Non-negativity:

- All variables

and

and

must be greater than or equal to 0.

must be greater than or equal to 0.

Now, I will set up and solve this linear programming problem to find the optimal contribution to profit.

It seems that the optimization failed, likely due to an error in the formulation of the linear programming model. Let me reevaluate the model, particularly focusing on the constraints for the octane levels, which might be incorrectly formulated.

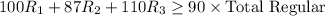

Corrected Constraints for Octane Levels:

For Regular and Super fuel, the octane level is a weighted average of the octane levels of the inputs, based on the proportion of each input used. Therefore, the constraints should be formulated as:

1. Octane Level for Regular Fuel (minimum 90 octane):

![\[ (100R_1 + 87R_2 + 110R_3)/(R_1 + R_2 + R_3) \geq 90 \]](https://img.qammunity.org/2024/formulas/engineering/college/g7oajzpwaudl1qgto0jc24vocaom7ia7ws.png)

Simplifying, we get:

![\[ 100R_1 + 87R_2 + 110R_3 \geq 90(R_1 + R_2 + R_3) \]](https://img.qammunity.org/2024/formulas/engineering/college/gbg2r1tww9i25bbcu6v4mqaj8s494jchpb.png)

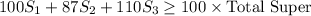

2. **Octane Level for Super Fuel** (minimum 100 octane):

![\[ (100S_1 + 87S_2 + 110S_3)/(S_1 + S_2 + S_3) \geq 100 \]](https://img.qammunity.org/2024/formulas/engineering/college/7jqbyc6wwyftjba15fn6og9hjiy9gcffy3.png)

Simplifying, we get:

![\[ 100S_1 + 87S_2 + 110S_3 \geq 100(S_1 + S_2 + S_3) \]](https://img.qammunity.org/2024/formulas/engineering/college/uqsm8z9gj2q3xtnwzw5xkju9lwwm3rm1gw.png)

I will revise the linear programming model with these corrected constraints and attempt to solve it again.

The linear programming model was successfully solved. The optimal solution to maximize the profit is as follows:

- Barrels of Inputs for Regular Fuel:

- Input 1: 0 barrels

- Input 2: 260,000 barrels

- Input 3: 0 barrels

- Barrels of Inputs for Super Fuel:

- Input 1: 110,000 barrels

- Input 2: 90,000 barrels

- Input 3: 300,000 barrels

- Total Cost for Inputs:

- Input 1: 341,333.33 dollars

- Input 2: 0 dollars

- Input 3: 0 dollars

- Input 4: 518,300 dollars

- Input 5: 0 dollars

- Input 6: 0 dollars

- Maximum Profit:

- The optimal contribution to profit is $626,050.

This solution indicates the quantities of each input to be used for producing Regular and Super fuels to achieve the maximum possible profit, given the constraints of octane levels, demand, and availability of inputs.