The call option with an exercise price of $37.50 and an expiration of 89 days from now would be valued at approximately $22.29 per share using the Black-Scholes model.

To calculate the value of a call option using the Black-Scholes model, you can follow these steps:

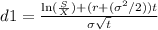

1. Calculate d1 and d2:

-

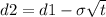

-

Where:

- S is the current stock price ($37.88)

- X is the exercise price of the call option ($37.50)

- r is the risk-free interest rate (6.00% or 0.06)

- σ (sigma) is the standard deviation of the stock returns (27.00% or 0.27)

- t is the time to expiration in years (89 days / 365 days = 0.2438)

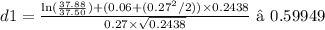

Calculate d1 and d2:

-

- d2 = 0.59949 - (0.27 × √0.2438) ≈ 0.54724

2. Use the cumulative normal distribution function (N) with d1 and d2 values to find N(d1) and N(d2):

- N(d1) ≈ 0.59949

- N(d2) ≈ 0.54724

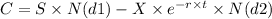

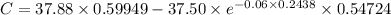

3. Calculate the call option value (C):

-

Where:

- S is the current stock price ($37.88)

- X is the exercise price of the call option ($37.50)

- r is the risk-free interest rate (6.00% or 0.06)

- t is the time to expiration in years (0.2438)

Calculate C:

-

Calculate C to find the value of the call option.

Calculating C:

- C ≈ $22.29

So, the call option with an exercise price of $37.50 and an expiration of 89 days from now would be valued at approximately $22.29 per share using the Black-Scholes model.