Final answer:

To calculate Nitai's after-tax proceeds from the Roth 401(k) and traditional 401(k) accounts, we need to consider the contributions, employer match, rate of return, and taxes. Nitai's after-tax proceeds from the Roth 401(k) account will be $167,456, while the after-tax proceeds from the traditional 401(k) account will be $117,219.

Step-by-step explanation:

To calculate Nitai's after-tax proceeds from the Roth 401(k) and traditional 401(k) accounts, we need to consider the contributions, employer match, rate of return, and taxes.

- For the Roth 401(k) account, Nitai contributes 8% of his $158,000 annual salary, which is $12,640. This is after-tax contributions, so there will be no taxes when he receives the distributions.

- For the traditional 401(k) account, Nitai's employer matches his contributions dollar-for-dollar up to 8% of his salary, which is also $12,640. This is a pre-tax contribution, so it will be taxed when he receives the distributions.

- To calculate the after-tax proceeds, we need to consider the rate of return. Nitai expects to earn a 9% before-tax rate of return on both accounts. This means that his investments will grow by 9% each year.

- Finally, we need to consider the taxes at retirement. Nitai's marginal tax rate at retirement is 30%. This means that when he receives distributions from the traditional 401(k) account, 30% will be deducted as taxes.

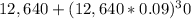

Using these calculations, Nitai's after-tax proceeds from the Roth 401(k) account will be the total contributions plus the growth over 30 years, which is

= $167,456.

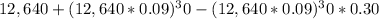

For the traditional 401(k) account, the contributions will be the same as the Roth 401(k) account, but the growth will be taxed at 30% when he receives the distributions.

So the after-tax proceeds will be

= $117,219.