The portfolio volatility is 25.6%

To estimate the volatility of an equally weighted portfolio, we can use the following formula:

Portfolio Volatility = σ * √(1 - ρ/N)

Where:

σ = Volatility of individual stocks

ρ = Correlation between pairs of stocks

N = Number of stocks in the portfolio

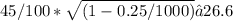

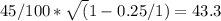

a. 1 stock

For a single stock, the portfolio volatility is simply equal to the volatility of the individual stock:

Portfolio Volatility =

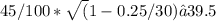

b. 30 stocks

With 30 stocks, the portfolio volatility decreases due to the diversification effect:

Portfolio Volatility =

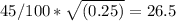

c. 1,000 stocks

With 1,000 stocks, the portfolio volatility is expected to approach the minimum achievable volatility, which is equal to the standard deviation of individual stock returns multiplied by the square root of the correlation between them:

Minimum Volatility =

For an equally weighted portfolio of 1,000 stocks, the portfolio volatility is very close to the minimum achievable volatility:

Portfolio Volatility =