a. Is the system worth installing if the required rate of return is 9%?

The system is worth installing at a required rate of return of 9%.

b. What if the required return is 14%?

Since the NPV is negative, the system is not worth installing at a required rate of return of 14%.

c. How high can the discount rate be before you would reject the project?

The IRR for this project is approximately 11.81%.

How to solve

The discount rate can be as high as 11.81% before the project would be rejected.

How to solve

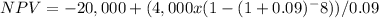

a. Is the system worth installing if the required rate of return is 9%?

Using the NPV formula, we calculate the net present value (NPV) of the project at a discount rate of 9%:

NPV = -Initial Outlay + ∑ Discounted Cash Flows

NPV ≈ $13,077

Since the NPV is positive, the system is worth installing at a required rate of return of 9%.

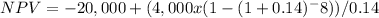

b. What if the required return is 14%?

Using the NPV formula again, we calculate the NPV of the project at a discount rate of 14%:

NPV ≈ -$2,984

Since the NPV is negative, the system is not worth installing at a required rate of return of 14%.

c. How high can the discount rate be before you would reject the project?

The discount rate at which the NPV is zero is the internal rate of return (IRR). We can calculate the IRR using financial calculators or spreadsheet software. The IRR for this project is approximately 11.81%.

Therefore, the discount rate can be as high as 11.81% before the project would be rejected.