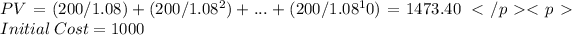

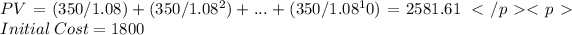

To calculate the Present Value (PV) of each project, we need to discount the annual cash flows at the required return rate of 8%. Then, we can calculate the Net Present Value (NPV) for each option:

For Tilapia:

NPV of Tilapia = PV - Initial Cost = 1473.40 - 1000 = 473.40

For Pollock:

NPV of Pollock = PV - Initial Cost = 2581.61 - 1800 = 781.61

To calculate the Profitability Index (PI), we divide the NPV of each project by the initial cost:

Since we are interested in the increment (difference) between the two projects, we calculate:

The Profitability Index of the incremental project is approximately -0.0392. None of the given choices match this value precisely, but the closest option is: