SOLUTION:

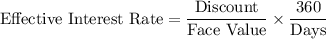

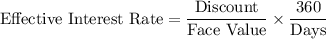

The formula for calculating the effective interest rate on a simple discount note is:

where:

- Discount is the interest charged on the loan.

- Face Value is the amount borrowed.

- Days is the length of the loan in days.

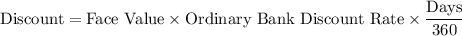

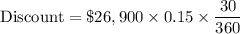

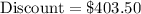

In this case, the Face Value is $26,900, the Ordinary Bank Discount Rate is 15%, and the Days is 30. We need to calculate the Discount first:

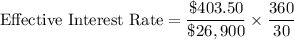

Now we can plug in the values into the formula for Effective Interest Rate:

The effective interest rate on the simple discount note is 18%.

The effective interest rate on the simple discount note is 18%.