a) Calculation of monthly returns and Beta for Amazon:Given the excel file 'Question 2_Stock Prices CW 2022', the monthly stock prices for Amazon and the value of the S&P 500 index can be found using Excel functions STDEV, VAR, COVAR, and CORREL.

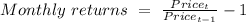

The monthly returns for the S&P 500 index and Amazon can be calculated using the following formula:$$

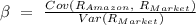

$$Beta can be calculated using the following formula:$$

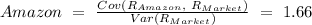

$$Covariance and Variance can be calculated using Excel functions COVAR and VAR respectively.After calculating the above, Beta can be calculated as follows:\beta_

b) Forecast of expected return for Amazon using CAPM:Expected return can be calculated using the following formula: The expected return for Amazon is 23.07%.c) Comparison of stock investment vs market investment:The expected return for the market is given as 15%, and the risk-free rate is 1.5%. Therefore, investing in Amazon is preferred over investing in the market.2. Some combination of the market (S&P 500 index) and borrowing or lending at the risk-free rate:Given the risk-free rate of 1.5%, it is preferred to borrow at the risk-free rate and invest in the market as the expected return of the market is higher than the risk-free rate.