Answer:

$1,397.17

Explanation:

To calculate the monthly mortgage payments, we need to determine the loan amount after the down payment and then use Monthly Payment Formula to calculate the monthly payments.

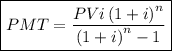

Monthly Payment Formula

where:

- PMT = Monthly payment.

- PV = Loan amount.

- i = Interest rate per month (in decimal form).

- n = Term of the loan (in months).

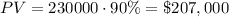

If the house costs $230,000, and a down payment equal to 10% of the price of the house is made, then the value of the loan (PV) is:

If the APR is 5.27%, then the value of i is:

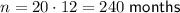

If the term of the loan is 20 years, then the value of n is:

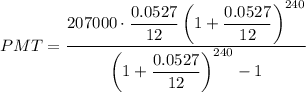

Substitute the values into the formula:

Using a calculator to evaluate, we get:

Therefore, the monthly mortgage payment would be approximately $1,397.17 (to the nearest cent).