Answer:

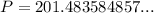

$201.48

Explanation:

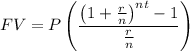

To determine the quarterly payments needed for the annuity to reach a total value of $12,000 after 11 years, we can use the formula for the future value of an ordinary annuity:

where:

- FV = Future value of an ordinary annuity.

- P = Value of each payment.

- r = Annual interest rate (in decimal form).

- n = Number of times interest is applied per year.

- t = Time (in years).

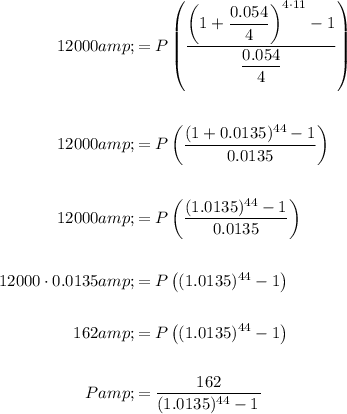

Given values:

- FV = $12,000

- r = 5.4% = 0.054

- n = 4 (quarterly)

- t = 11 years

Substitute the values into the formula and solve for P:

Evaluate using a calculator:

Therefore, the Smith family needs to pay approximately $201.48 into the annuity each quarter to accumulate a total value of $12,000 after 11 years, considering a 5.4% interest rate compounded quarterly.