The amount that you should pay for an annuity to receive payments of $1800 annually over the 17-year period at a guaranteed rate of 7.41% compounded annually is $16, 127.90.

The future value of the annuity at the end of 17 years can be calculated by using the formula below:

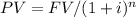

![FV = PMT * [(1 + i) ^ n - 1] / i](https://img.qammunity.org/2024/formulas/business/high-school/ub1269aowh0mx8pgj2k9rjcr66fmhw1xw7.png) Where; PMT = $1800 annually n = 17 year si = 7.41% compounded annually (i.e., 0.0741). By substituting these values, we have;FV = $1800 * [(1 + 0.0741) ^ 17 - 1] / 0.0741= $45,154.91The amount that you need to pay for the annuity can be obtained by discounting the future value (FV) back to the present value (PV) using the formula below:

Where; PMT = $1800 annually n = 17 year si = 7.41% compounded annually (i.e., 0.0741). By substituting these values, we have;FV = $1800 * [(1 + 0.0741) ^ 17 - 1] / 0.0741= $45,154.91The amount that you need to pay for the annuity can be obtained by discounting the future value (FV) back to the present value (PV) using the formula below:

By substituting the values, we have: , 127.90Therefore, you should pay $16,127.90 for an annuity that offers a guaranteed rate of 7.41% compounded annually to receive payments of $1800 annually over the 17-year period.

By substituting the values, we have: , 127.90Therefore, you should pay $16,127.90 for an annuity that offers a guaranteed rate of 7.41% compounded annually to receive payments of $1800 annually over the 17-year period.