Once the linear programming model is set up and solved, we can provide Mr. Smith with the recommended allocation of his $800,000 among the Alpha, Bravo, and Charlie funds, along with the anticipated annual yield based on the optimal solution. Additionally, we can analyze how changes in risk tolerance and fund yields would impact the investment recommendation.

To solve this asset allocation problem and recommend an optimal investment portfolio for Mr. Smith, we can use linear programming. The goal is to maximize the annual yield while considering the constraints imposed by XYZ's guidelines and Mr. Smith's risk tolerance.

Decision Variables:

Let:

-

be the amount (in dollars) invested in the Alpha fund.

be the amount (in dollars) invested in the Alpha fund.

-

be the amount (in dollars) invested in the Bravo fund.

be the amount (in dollars) invested in the Bravo fund.

-

be the amount (in dollars) invested in the Charlie fund.

be the amount (in dollars) invested in the Charlie fund.

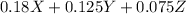

Objective Function:

We want to maximize the annual yield, which is a weighted sum of the yields from the three funds:

Maximize:

Constraints:

1. Total Investment Constraint: The total amount invested should be equal to $800,000.

![\[X + Y + Z = 800,000\]](https://img.qammunity.org/2024/formulas/business/high-school/n84orduweqcl72v0fs3dzgzed85met7172.png)

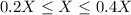

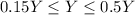

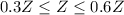

2. Minimum and Maximum Percentage Constraints:

- Alpha Fund:

- Bravo Fund:

- Charlie Fund:

3. Risk Tolerance Constraint: The overall portfolio risk index should not exceed 0.05 (Mr. Smith's risk tolerance).

![\[0.1X + 0.06Y + 0.02Z \leq 0.05(X + Y + Z)\]](https://img.qammunity.org/2024/formulas/business/high-school/a0y3qxkz2p5ir416oed6h4lkzbuuxjss1y.png)

Solver Setup:

We will use a linear programming solver to find the optimal solution to this problem. The objective is to maximize the annual yield subject to the constraints mentioned above.

Analysis and Recommendations:

1. If Mr. Smith's risk index is increased to 0.06, we can adjust the risk tolerance constraint accordingly and re-run the optimization. The yield may increase, but the specific values will depend on the new solution.

2. If the annual yield for the Alpha fund is revised downward to 17.5% or 16%, we can modify the objective function accordingly and re-optimize to find the new allocation and yield.

3. If Mr. Smith is concerned about having too much money in the Alpha fund, we can introduce an additional constraint to ensure that the amount invested in Alpha does not exceed the amount invested in Bravo

.

.