Answer:

43) 79 years and 6 months

44) 17 years and 6 months

Explanation:

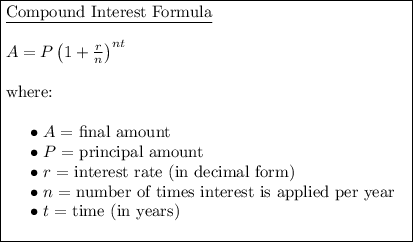

As the account increases by a constant percentage bi-monthly, we can use the compound interest formula to write a function to model the situation.

The interest is compounded bi-monthly, which means every 2 months.

Therefore, the interest is applied 6 times per year.

Given values:

- A = $10,000

- P = $2,400

- r = 1.8% = 0.018

- n = 6 (bi-monthly)

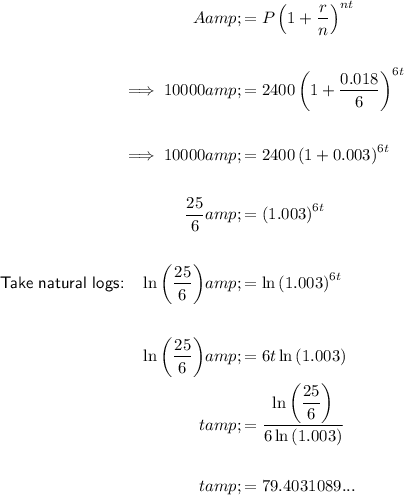

Substitute the given values into the formula, and solve for t:

The account balance will reach $10,000 during the 79th year (after 79 years and 4.84 months).

As the interest is applied bi-monthly (every 2 months) we need to round up to the nearest 2 month interval. Therefore, the account balance will reach $10,000 after 79 years and 6 months.

Note: After 79 years and 4 months, the account balance will be $9,987.47, and after 79 years and 6 months it will be $10,017.43.

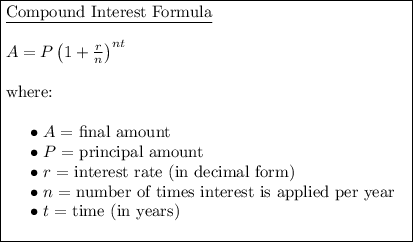

As the account increases by a constant percentage quarterly, we can use the compound interest formula to write a function to model the situation.

The interest is compounded quarterly, which means every 3 months.

Therefore, the interest is applied 4 times per year.

Given values:

- A = $60,000

- P = $30,000

- r = 4% = 0.04

- n = 4 (quarterly)

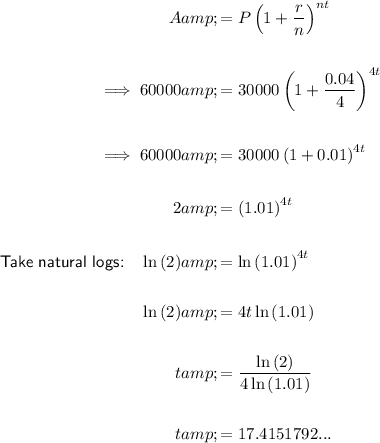

Substitute the given values into the formula, and solve for t:

The value of the investment account will double during the 17th year (after 17 years and 4.98 months).

As the interest is applied quarterly (every 3 months) we need to round up to the nearest 3 month interval. Therefore, the investment account will double by 17 years and 6 months.

Note: After 17 years and 3 months, the account balance will be $59,606.83, and after 17 years and 6 months it will be $60,202.90.