Solving systematically, the maximum price per share that Orca should pay for Shark is $69.95.

How is that so?

To calculate the Maximum Price per Share for Orca's Acquisition of Shark, given information:

- Current cash flow from assets (CF0) = $8.3 million

- Growth rate for next 5 years (g1) = 7%

- Growth rate for indefinite future (g2) = 4%

- Cost of capital for Orca (ke) = 11%

- Cost of capital for Shark (ks) = 9%

- Number of shares outstanding (n) = 3 million

- Debt outstanding (D) = $25 million

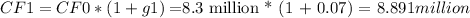

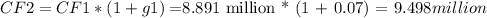

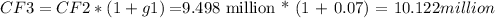

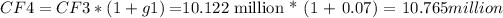

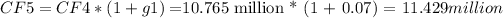

Step 1: Calculate the expected cash flows for the next 5 years.

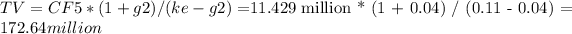

Step 2: Calculate the terminal value (TV).

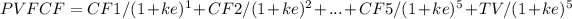

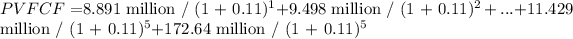

Step 3: Calculate the present value of future cash flows (PVFCF).

Step 4: Calculate the total enterprise value (EV).

EV = PVFCF + TV + D

EV = $37.22 million + $172.64 million + $25 million

EV = $234.86 million

Step 5: Calculate the equity value.

EV = E + D

E = EV - D

E = $234.86 million - $25 million

E = $209.86 million

Step 6: Calculate the maximum price per share (P).

P = E / n

P = $209.86 million / 3 million

P = $69.95

Therefore, the maximum price per share that Orca should pay for Shark is $69.95.