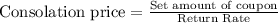

Answer:

Follows are the solution to this question:

Step-by-step explanation:

Its console shall be coordinated effort mutual funds which do not grow at all, and in every year they create a corrected degree of interest, that's why Its bond paying a fixed rate of the coupon but not maturing.

It's the price that the government needs to offer shareholders.