Wyatt can borrow approximately $186,064.78 for a 30-year house loan with a 7.2% APR, compounded monthly, while maintaining a monthly payment of $1290.

To calculate the maximum amount Wyatt can borrow for a 30-year house loan with a 7.2% APR, compounded monthly, given a monthly payment of $1290, we can use the loan payment formula:

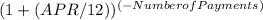

Loan Amount = Monthly Payment / ((APR/12) * (1 -

))

))

Substituting the given values:

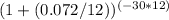

Loan Amount = 1290 / ((0.072/12) * (1 -

))

))

After calculating, the result is approximately $186,064.78. Therefore, Wyatt can borrow a maximum of around $186,064.78 for a 30-year house loan with a 7.2% APR, compounded monthly, while making monthly payments of $1290.

Complete question:

What is the maximum amount Wyatt can borrow for a 30-year house loan with a 7.2% APR, compounded monthly, if he can afford a monthly payment of $1290?