Answer:

$5,759.90

Explanation:

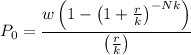

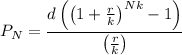

First, we need to calculate how much money should be accumulated in the account during the 20 years prior to retiring in order to have enough to withdraw $30,000 at the beginning of each year for 25 years after retiring. To calculate this, we can use the payout annuity formula.

where:

- P₀ is the balance in the account at the beginning.

- w is the regular withdrawal (the planned amount to withdraw each time period).

- r is the annual interest rate (in decimal form).

- k is the number of compounding periods in one year.

- N is the number of years to take withdrawals.

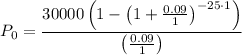

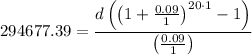

In this case:

- w = $30,000

- r = 9% = 0.09

- k = 1 (assuming the interest compounds annually)

- N = 25 years

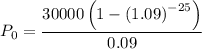

Substituting the values into the formula gives:

Therefore, the balance of the account at the beginning of retirement needs to be $294,677.39.

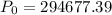

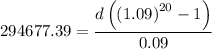

Now, to calculate how much we need to deposit at the end of each year for the duration of 20 years before retirement to achieve the required initial retirement balance of $294,677.39, we can use the savings annuity formula:

where:

is the balance in the account after N years.

is the balance in the account after N years.- d is the regular deposit amount (the planned amount to deposit each time period).

- r is the annual interest rate (in decimal form).

- k is the number of compounding periods in one year.

- N is the number of years .

In this case:

= $294,677.39

= $294,677.39- r = 9% = 0.09

- k = 1 (assuming the interest compounds annually)

- N = 20 years

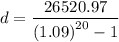

Substituting the values into the formula gives:

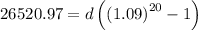

Solve for d:

Therefore, the amount needed to be deposited at the end of each year to achieve the given retirement goals is $5,759.90.