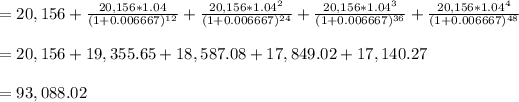

Answer: $93,088

Step-by-step explanation:

Rate is compounded monthly which makes it:

= 8% / 12

= 0.6667%

= 0.006667

The payment of $20,156 is to increase yearly at a rate of 5%. Payments are at the beginning of the period so the first payment does not have to be discounted.

= $93,088