Main Answer:

The present value (PV) of the perpetuity is

Step-by-step explanation:

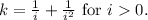

The present value of a perpetuity is determined by summing the present values of each cash flow it generates. In this case, the perpetuity pays 1 at the end of every year and an additional 1 at the end of every second year. The formula for the present value of a perpetuity is

is the discount rate. In this scenario,

is the discount rate. In this scenario,

. The first term

. The first term

represents the present value of the yearly cash flow, and the second term

represents the present value of the yearly cash flow, and the second term

represents the present value of the cash flow every second year.

represents the present value of the cash flow every second year.

Combining these, the formula for the present value of the perpetuity is

This equation represents the present value of all future cash flows generated by the perpetuity. To find the present value, one needs to solve fo

This equation represents the present value of all future cash flows generated by the perpetuity. To find the present value, one needs to solve fo

This expression captures the discounted value of both the yearly and biennial cash flows, providing a comprehensive measure of the perpetuity's present worth.

This expression captures the discounted value of both the yearly and biennial cash flows, providing a comprehensive measure of the perpetuity's present worth.